By Gourangalal Das, Director General of India Taipei Association

We live in the digital age, where software and hardware are increasingly converging. India is no exception to this global trend. Our economic prosperity and long-term growth are intrinsically tied to our digital future. India has long boasted globally recognized strength in software and IT solutions. Recent policy initiatives have also provided impetus for our country to go digital: countrywide access to broadband internet has been ensured; a digital unique dentification has been provided to every Indian; government service delivery has largely moved online. The list goes on.

In contrast, our manufacturing of electronics hardware has traditionally lagged behind. Large and growing import bill of electronic products reached unsustainable proportion a few years back, posing challenges for economic and information security in some cases. In recognition of this and to prepare ourselves better for the coming digital age, Government of India made electronic manufacturing a core and a highlight of its "Make in India" programme. It is a flagship programme to increase the share of manufacturing in GDP with facilitation and support. In just a few years, electronics manufacturing has emerged as a top success story under this programme. Thanks to this initial success, the Government and the industry are setting even more ambitious goals.

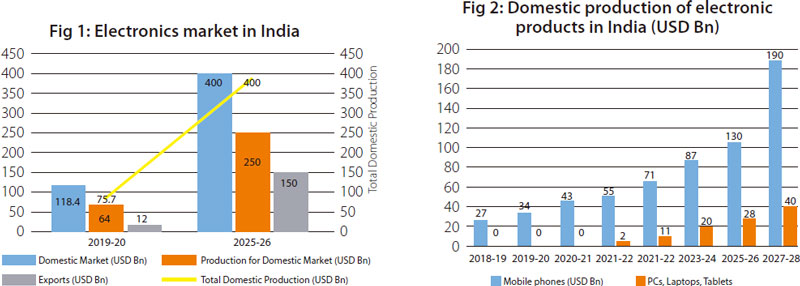

Indian domestic electronics market currently stands at about US$ 120 billion. Following interventions under the Make in India policy, domestic production of electronics hardware has increased substantially from US$ 29 billion in 2014-15 to over US$ 75 billion in 2019-20, at a Compound Annual Growth Rate of 23%. India's share in global electronics manufacturing has also grown from 1.3% in 2012 to 3.6% in 2019. Even more impressive is the growth potential of this sector. With rapidly growing demand for IT products, office automation, telecom, consumer electronics, aviation, aerospace, defense, renewable energy, automobiles and medical electronics, the domestic market for electronics is projected to grow to US$ 400 billion by 2025 (fig 1).

India's electronics focus has provided enormous opportunities for win-win cooperation between Indian and Taiwan electronics and electrical industry players. Taiwan and Taiwanese companies have been India's preferred partners in promoting domestic manufacturing of electronics.

Encouraged by Government policies like Modified Special Incentive Package Scheme (M-SIPS), Electronic Manufacturing Clusters (EMC) and Production-Linked Incentive (PLI) for mobile phones and IT Hardware, many well-known Taiwanese ICT and ESDM companies, including Foxconn, Wistron, Pegatron, and Delta electronics etc. have established or expanded their operations in India. Some of them also brought their supply chain partners along with them, making India one of their regional manufacturing hubs and offering yet another exciting avenue for growth of Taiwan's small and medium supply chain partners.

With new opportunities in electronics manufacturing being unveiled in India and the pace of India's digital transformation further accelerating, I see even better prospect for bilateral cooperation with Taiwan. In the following, I identify a few emerging areas in which Taiwan's electronics industry can cultivate the Indian market. I will also cover some policy and infrastructure support to support their investment.

a.Semiconductors

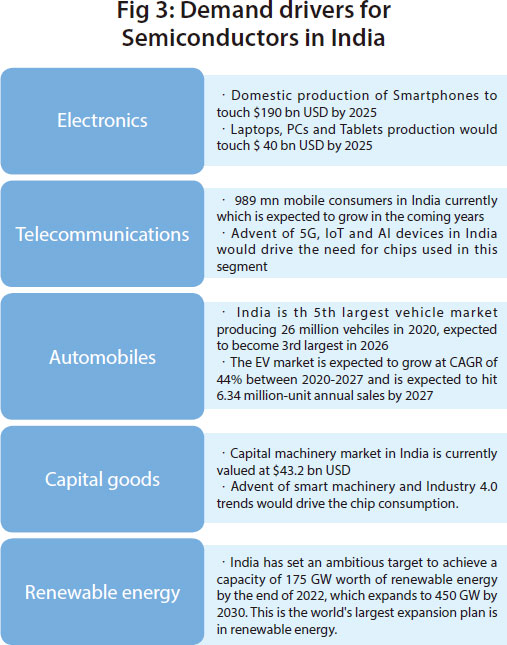

Like the rest of the world, India is voraciously adopting ICT products and new technologies like next generation communications (5G) and clean energy vehicles, driving up demand for semiconductors. India's semiconductor demand is currently valued around US$ 24 billion. With the increasing domestic production of electronics, including for mobiles phones, laptops, tablets & PCs, consumer appliances and automobiles (Fig 2 & Fig 3), the domestic demand for semiconductors is expected to touch US$ 100 billion by 2024-25. As per current industry breakup, this translates into an annual sales opportunity of US$ 20 billion for foundries to take advantage of.

At present, India's IC demand is completely met through imports. This is unsustainable in the long-run; we must have domestic alternatives to meet some of the projected demand for the chips in the coming years. In view of this, overnment of India last year invited ‘Expression of Interest' from global companies to understand their requirements and expected policy support for setting up a Fab in India. Currently, such feedbacks are under serious evaluation by the Government, following which policy incentives may be offered to qualified foundries to set up their operation in India. Government of India is also committed to providing infrastructure and supporting ecosystem to make these operations commercially profitable.

As Taiwan is the global leader in IC manufacturing, we would like to see active participation by Taiwan's companies in these projects. Their early entry will ensure leadership position in a large and growing market for IC, besides helping operations of other Taiwanese electronics manufacturers in India.

b.Display

Displays account for over 25% of the cost of smartphones and over 50% in case of LCD / LED TVs.

India's display panel market is estimated at US$ 7 billion and expected to grow to US$ 19 billion by 2025. The demand growth will be supported by large increase in domestic manufacturing of a wide range of electronic products for use in consumer products, medical devices, automobile displays etc.

Even as globally display industry is shifting away from LCD technology, it still retains significant market share owing to cost competitiveness. India's medium-term consumption pattern will remain suitable for mature LCD display technologies, where Taiwan's industry is strong.

Government of India earlier this year invited ‘Expressions of Interest' from global display majors to understand their requirements to set up a display facility in India. Once policy support is announced, this sector will provide yet another opportunity to Taiwan's businesses to enter India, either by themselves or in cooperation with Indian companies, who are very upbeat about the potential of display industry in India.

b.Display

Displays account for over 25% of the cost of smartphones and over 50% in case of LCD / LED TVs.

India's display panel market is estimated at US$ 7 billion and expected to grow to US$ 19 billion by 2025. The demand growth will be supported by large increase in domestic manufacturing of a wide range of electronic products for use in consumer products, medical devices, automobile displays etc.

Even as globally display industry is shifting away from LCD technology, it still retains significant market share owing to cost competitiveness. India's medium-term consumption pattern will remain suitable for mature LCD display technologies, where Taiwan's industry is strong.

Government of India earlier this year invited ‘Expressions of Interest' from global display majors to understand their requirements to set up a display facility in India. Once policy support is announced, this sector will provide yet another opportunity to Taiwan's businesses to enter India, either by themselves or in cooperation with Indian companies, who are very upbeat about the potential of display industry in India.

c.ATMP

Together with semiconductor design and manufacturing, India is hoping to build up downstream industries like ATMP.

The robust demand for ICs across various product segment and the low investment and technology threshold of ATMP, makes it a low-risk and assured point of entry for industries in the semiconductor value chain into India.

Government of India is expected to come up with policy incentives in this field.

Taiwan is a global leader in ATMP processes, counting six of the top ten IC packaging and testing companies as its members. I am confident that they can grow their busines well and enhance the resilience of electronics supply chains by investing in domestic ATMP capabilities in India, either in partnership with Indian companies or by themselves.

d.Electronic components

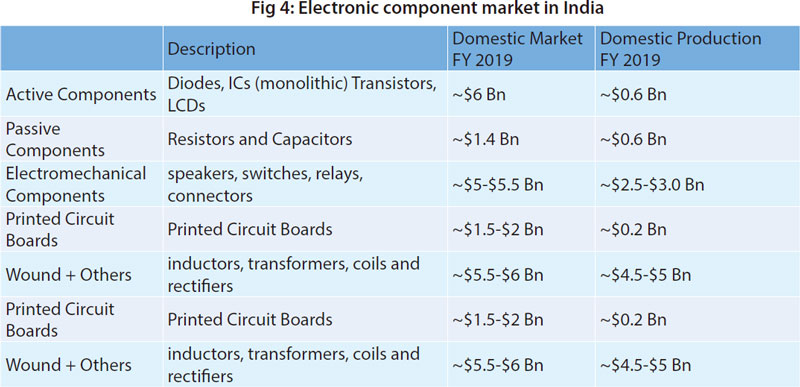

Growth in the Indian electronic components market is driven by rising local demand and an expanding electronics ecosystem. The Indian electronic components market grew from US$ 11 billion in FY 2009 to about US$ 21 billion in FY 2019, with a healthy annual growth rate of around 7%. Active components including, diodes, IC transistors etc., constitute the largest share within the Indian components market and the domestic production market, closely followed by the electromechanical and wound components (Fig 4).

Government of India recognizes that in order to create a complete and resilient electronics supply chain in India, localization of component manufacturing capability is of utmost importance. It has come forward with a Scheme for Promotion of Electronic Components and Semiconductors (SPECS) to provide a 25% subsidy on the capital expenditure incurred by eligible companies to establish component manufacturing facility in India. Many Taiwanese companies have already availed of the benefits of the scheme by moving their production facilities to India as part of electronics supply chains. The scheme is still open and Taiwan's component manufacturers can apply until 2023.

Benefits will cover their investments in India for a period of up to five years from the date of acknowledging the applications. Taiwanese companies, especially small and medium enterprises could find this of utmost interest in considering their entry into India.

e.R&D

India offers a unique combination of advantages for investment in electronics R&D: massive market opportunity, technical competency, cost-effectiveness, proactive government support, and abundant workforce. India produces over a million engineering and science graduates every year and has a globally renowned IP protection system, making India a natural choice as R&D base for many global corporations including Qualcomm, Microsoft, Google, Facebook, Mediatek & Intel etc., helping India become one of the major IT R&D hubs in the world.

Taiwanese hardware manufacturers could leverage India's position as a hub to create frugal and innovative solutions and to design products and solutions specific to the Indian market, which can be replicated around similar economies.

Government support for R&D establishment in India includes allowing deduction of expenses incurred in the purchase of R&D equipment for taxation purposes, in addition to allowing their duty-free import into the country. Government also allows a concessional tax rate on income earned by royalty in respect of patents developed and registered in India.